Rent a Treasurer : https://treasuryxl.com/news-articles/rent-a-treasurer/

Read following article: The Evolution of Legal Documents, The Next Step

22-02-2022 | Wim Kok | treasuryXL | LinkedIn |

A fantastic end-to-end digital journey has begun to create a paperless supply chain ecosystem for the benefit of all parties concerned in the documentary (paper heavy) Supply Chain settlements of today.

For this Enigo AB (www.Enigio.com) started at the basis of the current standard, the paper document. A clean sheet of paper!

A large share of the communication in a trade finance transaction is already digitalised. Banks structure customer communication through portals, negotiate via safe e-mail and sign using e-signatures, not to forget SWIFT which has already enabled the digitalisation of many products and process steps between banks. A major obstacle for achieving a completely digital trade finance world has been the requirements to be able to manage and present documents in their original form. Enigio’s focus has therefore been to create a digital document with the same properties as its paper equivalent. The trace:original document is designed to be able to hold all necessary data to execute a transaction and at the same time not being tied to any specific transaction infrastructure. More importantly it can also be managed by anyone with access to a computer and the internet.

How does the solution work? Watch below video:

Following the accelerating momentum (after and pushed by the Covid pandemic), we see changing environment in the banking landscape, which is becoming rapidly more adoptive for transformation, especially digitalisation of the paper heavy trade documentation evidencing import- and export transactions. Both infrastructures, paper and digital documents must co-exist. There will be countries being early digital adopters and others lagging. An infrastructure agnostic digital trade finance document of any type can serve all the aspects of the global digital ambition extremely well. Interoperability can be achieved on different levels and by using different tools. One of the most forceful ways of achieving interoperability is by standardisation of data definitions and data formats. Json Schemas and the trace:original document is a perfect connector to achieve digital interoperability not only between blockchain based trade finance platforms but for all trade finance platforms.

The banks’ lack of investment decisions for end-to-end digitised trade processes impacting their customers have created a large cost effect on corporations.

- Banks additionally impose costs on their corporate customers as they lack strategic vision on operative and compliance issues. Still manual or dual processes that are partly broken and very costly for all parties

- Banks also impose costs internally for front, middle and back-office and create compliance risks with manual or partly manual processes

- Trade finance digitalisation is a strategic issue for a bank and its corporate customers and is undergoing rapid change

- Many solutions and offerings to choose from but a lack of basic digital standards internally and when interacting with others

- Cost and risk/AML issues for all parties

- Bank’s role is to help to prioritise the trade finance short-term initiatives that will support corporate treasuries long-term objectives

- Banks should be firm with their opinion about coherent direction and help corporates to reduce the uncertainty that comes with trade finance digitalisation.

Conclusion

Footnote: further detail to be found on the website: www.Enigio.com

- Several whitepapers

- Walkthrough gallery of (1min.) YouTube videos explaining product usage very clear

- Modules for bank guarantees, Standby L/Cs, Prom Notes, Bills of Exchange and eB/Ls

Thank for reading and stay tuned!

International Business Consultant

Trade Finance Specialist

Read following article: How to simplify Procurement and Finance in the Supply Chain

| 21-04-2020 | Wim Kok | treasuryXL

Accelerated by the Corona pandemic, an unforeseen global crisis affecting us all, digitalisation, transparency, efficiency and real time settlement has moved dramatically up north on the priority scale of all global industries. At least it makes an important move to rethink sustainable business models in the post Corona era.

Secured (cyber proof) Platform connectivity bolstering strategic supply chains will become a very important aspect in the future survival of trading companies globally.

More and more initiatives are seen to phase out the “old school” handling of paper-based settlement. Rain forest of papers are being used to settle payment out of export and import contracts. Its cumbersome processes to settle payments through bank using old payment methodologies like Bills of Exchange, Cash Against Documents and Documentary Letters of Credit. Do not misunderstand my objective, nowadays contract settlements are strongly embedded in society supported by different legislation countries by country. This is also the reason why things are moving so slowly. Institutions like ICC, Swift, Customs & Harbour authorities (to name few) are constantly trying to move the needle in digitising processes. The reality is that the transformation goes to slowly. Maybe when COVID19 is behind us there will be an acceleration after reconsidering existing business models of supply chains dependent from documentary evidence.

In this 15 trillion USD ($) global trade market there is enough space next to the big banks and big corporates, who started to explore already after the 2008 crisis using agile inhouse innovation labs.

Initiatives like Komgo and R3 syndicates already looking at blockchain technology, however still geared toward the larger (commodity) trading community. It is interesting to see that the big Agri trading companies recently started a new initiative Covantis.

After PSD2 introducing Open banking a lot of financial FinTech’s are entering the market not having the burden of an absolute (outdated) big banking system. Big tech giants like google, Facebook and Amazon are looking into their enormous data bases trying to grasp their market share.

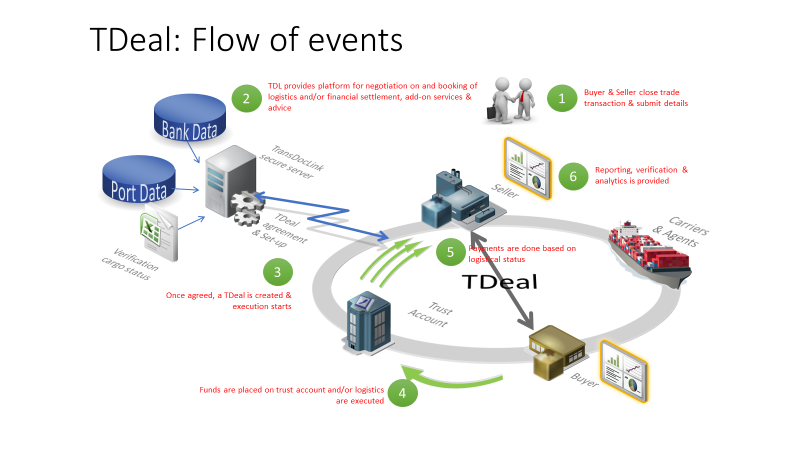

TransDocLink is developing a platform based upon the above ideas, capturing as much as possible stakeholders & features. Transdoclink already can make use of the TDeal concept on its platform. Creating in a supplier/buyer relationship full transparency, efficiency and trust in their contracted supply chain. A dashboard gives visibility around the whereabouts of the goods and money (triggered movements are settled through a dedicated wallet). TransDocLink aims to serve the SME market in an open (independent) platform environment.

In 2016 TransDocLink already recognised that the Letter of Credit (and its very paper heavy documentary settlement) is a “dinosaur” in the expensive settlement of payments in the banking industry. The aim was to digitise these processes and offer an alternative on a platform-based initiative. Buyer and Seller create on the platform a trusted lane (supply chain) by matching contracts. The settlement of agreed terms is being executed through an independent trust account instead of the alternative using an expensive settlement via Letter of Credit. The original concept was built around a straight through processing payment engine (exempted by the Dutch Central bank) and further enhancements are being made (escrow-TDeal , working capital, asset based & trade finance modules) to keep up with the quick changing landscape in the FinTech industry.

Curious what TransDocLink can do for your business? Visit www: transdoclink.com and/or contact me directly for some advice.

International Business Consultant

Trade Finance Specialist

https://treasuryxl.com/wp-content/uploads/2021/02/Rent-a-Treasurer_Seasoned-Treasurers_Overview.pdf